The UAE continues its trajectory toward regulatory modernization and global competitiveness through the issuance of Federal Decree-Law No. 20 of 2025, which amends key provisions of Federal Decree-Law No. 32 of 2021 on Commercial Companies. These amendments introduce modern governance mechanisms, enhanced shareholder protections, mobility for companies across licensing authorities, and increased flexibility in capital structuring.

This detailed legal commentary provides an in-depth analysis of each major amendment and explains how the 2025 reforms reshape the corporate landscape for UAE businesses.

- Expanded Scope of Companies Subject to the Law

The amendments reaffirm that the Commercial Companies Law applies to:

- All companies incorporated within the UAE,

- All foreign companies conducting activities or establishing management centers in the UAE, and

- Free zone companies operating outside their free zone boundaries.

This ensures regulatory uniformity and removes ambiguity for entities that function across mainland and free zone jurisdictions.

- Clarified Treatment of Free Zone Companies

Companies established in free zones continue to be governed by free zone regulations. However, if a free zone permits a company to conduct activities outside its geographical limits, such company becomes subject to the Commercial Companies Law for those external activities.

This dual-compliance regime requires careful structuring and coordination between free zone rules and federal corporate law.

- Revised Definition of “Company” and Introduction of Non-Profit Companies

The amended law refines the definition of a company as a contractual relationship involving contributions toward a profit-oriented economic activity.

A key development is the introduction of a legal framework for non-profit companies, which:

- Must reinvest all profits into their objectives,

- Cannot distribute profits to members or shareholders,

- May be exempted from parts of the law by Cabinet decision.

This opens the door for philanthropic, educational, social, and CSR-based entities to operate more formally in the UAE.

- Mandatory Corporate Legal Forms and Liability for Non-Compliance

The law reiterates the permissible company forms (LLC, PJSC, Private JSC, general partnerships, and simple limited partnerships).

If a company is established outside these approved forms, the entity is deemed invalid and the persons acting on its behalf are personally and jointly liable for all related obligations.

This ensures structural discipline and protects third parties engaging with such entities.

- Mandatory Use of Arabic in Corporate Constitutional Documents

Articles of Association and all amendments must be:

- Written in Arabic,

- Notarized by the competent authority,

- With Arabic prevailing in case of discrepancy between versions.

- Electronic notarization is permitted where authorized.

This enhances legal clarity and prevents interpretative conflict in corporate documents.

- Introduction of Modern Shareholder Rights and Transaction Mechanisms

One of the most progressive amendments allows companies, particularly LLCs and private JSCs, to incorporate advanced contractual arrangements directly into their constitutional documents, such as:

- Drag-Along Rights

Allowing majority shareholders to compel minority shareholders to participate in a sale.

- Tag-Along Rights

Allowing minority shareholders to join a sale initiated by majority shareholders on equal terms.

- Succession Rights Upon Death of a Shareholder

Including priority rights for remaining shareholders to acquire the deceased’s shares at an agreed price or at a value determined through expert valuation in case of dispute.

This statutory recognition modernizes UAE corporate practice and aligns it with international M&A norms.

- Strengthened Rules on Capital Contributions and Valuation of In-Kind Shares

The amended provisions introduce a robust valuation regime for non-cash contributions:

- Mandatory valuation by qualified experts,

- Oversight by relevant authorities over valuation methodology,

- Liability imposed on contributors if assets were intentionally overvalued,

- Authority’s right to appoint an alternative valuer if necessary.

These measures safeguard companies from inflated capital structures and promote transparency and financial accuracy.

- Introduction of Multiple Share Classes for LLCs

A landmark reform now allows LLCs to issue different classes of shares, differentiated by:

- Voting rights,

- Dividend entitlements,

- Redemption or buy-back rights,

- Liquidation preferences,

- Restrictions or privileges tailored to investor needs.

Each share class must be registered in the Commercial Register.

This offers substantial flexibility for structuring investments and makes LLCs more attractive for private equity funds, venture capital, and sophisticated investors.

- Enhanced Governance Framework for Directors and Managers

The amendments impose stricter rules governing:

- Removal of directors by shareholders or court order,

- Mandatory timelines for accepting or rejecting a director’s resignation,

- Notification requirements upon expiry of a director’s term,

- A maximum six-month extension for boards that fail to renew their composition, after which authorities may intervene and appoint temporary management.

These changes prevent governance gaps and promote accountability.

- Public and Private Joint-Stock Companies: Updated Rules on Offerings and Share Classes

Key updates include:

- Restrictions on public share offerings by non-public companies,

- Authorization for private JSCs to conduct private placements,

- Introduction of multiple share classes in JSCs,

- Enhanced oversight of in-kind share valuation,

- Clarification of shareholder rights and limitations on redemption of capital.

The Securities and Commodities Authority is authorized to issue additional regulations governing these matters.

- Lock-In Period for Share Transfers in Private Joint-Stock Companies

A private JSC may not transfer its shares for at least one full financial year following registration.

Exceptions include:

- Transfers between existing shareholders,

- Transfers by inheritance,

- Transfers resulting from bankruptcy,

- Judicially ordered transfers.

The Minister may modify or exempt companies from this lock-in requirement based on public interest or specific circumstances.

- Streamlined Corporate Transformations

Companies may convert from one form to another without losing their legal identity.

Notable simplifications include:

- No need for a new incorporation application,

- No need to establish a founders’ committee when converting into a JSC,

- Executive management may handle the entire conversion process unless the general assembly appoints a specific individual,

- JSC-converted entities must elect a board and appoint an auditor within 30 days after conversion.

This reform encourages growth, restructuring, and pre-IPO readiness.

- Groundbreaking Reform: Transfer of Commercial Registration Between Licensing Authorities

The introduction of a new article allows companies to transfer their commercial registration from one licensing authority to another—whether mainland to free zone, free zone to mainland, or between authorities—without losing their legal personality, provided:

- Both authorities permit the transfer,

- There are no legal restrictions on the company,

- All required regulatory and ministerial approvals are obtained.

This unprecedented mobility enhances strategic corporate planning, restructuring, and tax and regulatory optimization.

- Repeal of Conflicting Provisions

Any prior legal provisions inconsistent with the 2025 amendments are expressly repealed to ensure full alignment with the updated Commercial Companies Law.

Conclusion: A New Corporate Era for the UAE

Federal Decree-Law No. 20 of 2025 represents one of the most significant enhancements to the UAE’s corporate legal framework in recent years. It introduces:

- Strengthened governance and management oversight,

- Expanded corporate flexibility,

- Modern share structuring techniques,

- Enhanced investor protections,

- Simplified corporate transformations,

- Unprecedented mobility across licensing jurisdictions.

Companies operating in the UAE—whether mainland, free zone, or international groups with local subsidiaries—should immediately review:

- Their Articles of Association,

- Shareholder agreements,

- Capital structures,

- Governance policies,

- Expansion and restructuring strategies.

The amendments offer substantial opportunities to optimize ownership structures, facilitate investment, and align corporate frameworks with international best practice.

To know more, please feel free to reach out.

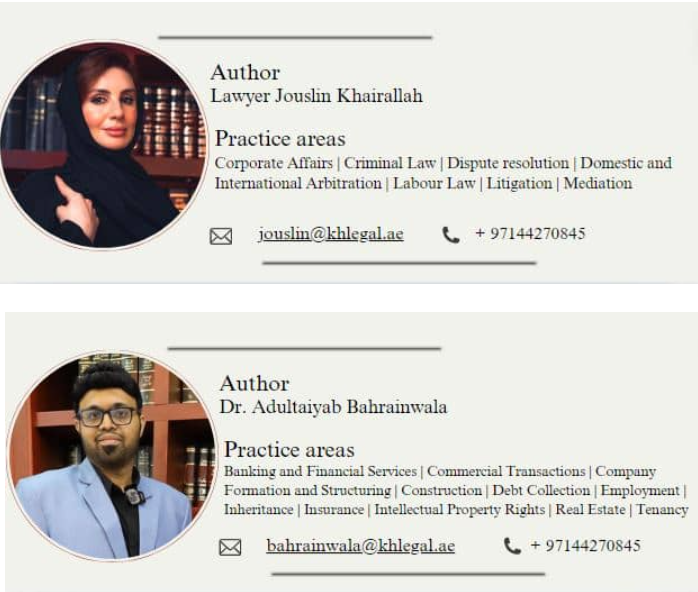

Authors: